Unlock the Power of Mobile Finance: A Comprehensive Look at Leading Payment Apps

PayPal - Send, Shop, Manage

Introduction

PayPal is a name synonymous with online payments and digital commerce. As one of the pioneers in the field, PayPal’s mobile app, "PayPal - Send, Shop, Manage," seeks to offer a seamless experience for sending money, shopping online, and managing transactions. Available on both iOS and Android, the app aims to bring convenience, security, and efficiency to mobile financial management.

User Experience

- Interface Design:PayPal's interface is sleek and modern, using a calming color palette dominated by blues and whites. The layout is intuitive, with prominent icons and easily accessible menus. Each section of the app—whether it's for sending money, shopping, or viewing transaction history—is clearly demarcated, making navigation straightforward even for new users. Icons and buttons are well-designed, blending functionality with a modern aesthetic that keeps users engaged.

- Interactive Design:Ease of use is a hallmark of PayPal’s mobile app. The navigation is logical and fluid; options for sending money, requesting payments, and shopping are clearly labeled. The app responds quickly to inputs, ensuring a seamless user experience. Transactions can be completed with just a few taps, and the transition between different sections of the app is smooth, reflecting the high responsiveness of the interface.

- Customization:PayPal offers a range of personalization options. Users can link multiple bank accounts and cards, set spending limits, and receive tailored notifications. These settings allow users to manage their finances in a way that suits their individual preferences and needs. Additionally, users can select preferred currencies, which is particularly useful for international transactions.

- Stability and Performance:Performance-wise, PayPal's app runs smoothly with minimal lag. Updates are regular, ensuring the app remains secure and up-to-date with the latest features. In my experience, crashes are rare, and the app can efficiently handle large volumes of transactions without compromising on speed or stability.

Features

- Core Functions:At its core, the PayPal app excels in facilitating money transfers and online purchases. Users can send or receive money instantly, either domestically or internationally. Shopping via PayPal is also streamlined, with the app integrating directly with numerous online retailers. This makes checking out a breeze, with just a login and a few clicks needed.

- Additional Functions:Beyond basic transactions, PayPal offers several supplementary features. These include mobile phone top-ups, cryptocurrency trading, and bill splitting, which further expand the app's utility. The integration with PayPal’s credit services also allows users to manage their PayPal Credit accounts directly within the app.

- Innovation:One of PayPal’s standout innovations is its strong security measures. Features such as fingerprint authentication and 2-factor authentication provide an additional layer of security. Another innovative feature is the ability to buy, sell, and hold cryptocurrencies directly within the app, catering to the growing interest in digital currencies.

Community and Support

- Community Engagement:PayPal has a large, active user community, often providing valuable feedback and sharing tips in forums and on social media. The robust community presence ensures that users can find guidance and support for various issues and questions.

- Customer Service:PayPal's customer service is comprehensive. Support is available via live chat, email, and phone, with quick response times. The detailed Help Center is filled with FAQs, user guides, and troubleshooting tips, reflecting a commitment to quality customer care.

Market Positioning

- Target Audience:PayPal is ideal for a wide audience, including individuals who frequently engage in online shopping, freelancers who need to manage payments from clients, and anyone looking for a secure way to handle online transactions. The app’s versatility makes it a valuable tool for both personal and small business financial management.

- Competitors:Competitors like Venmo and CashApp offer similar peer-to-peer payment features but may lack some of PayPal’s extensive transaction functionalities and international reach. Venmo excels in social payments, while CashApp offers straightforward money transfers but with fewer features.

Personal Insights

- Highlights:The most attractive feature of the PayPal app is its comprehensive suite of financial tools, all within a single platform. The ease of making international transfers and the robust security measures stand out as particularly valuable.

- Drawbacks:PayPal's complexity and extensive array of features might be overwhelming for some users. Additionally, the fees associated with certain transactions, such as currency exchanges and credit card payments, can be a downside.

| View > |

|---|

Ratings:

- Interface Design: 9/10

- Interactive Design: 9/10

- Customization: 8/10

- Performance: 9/10

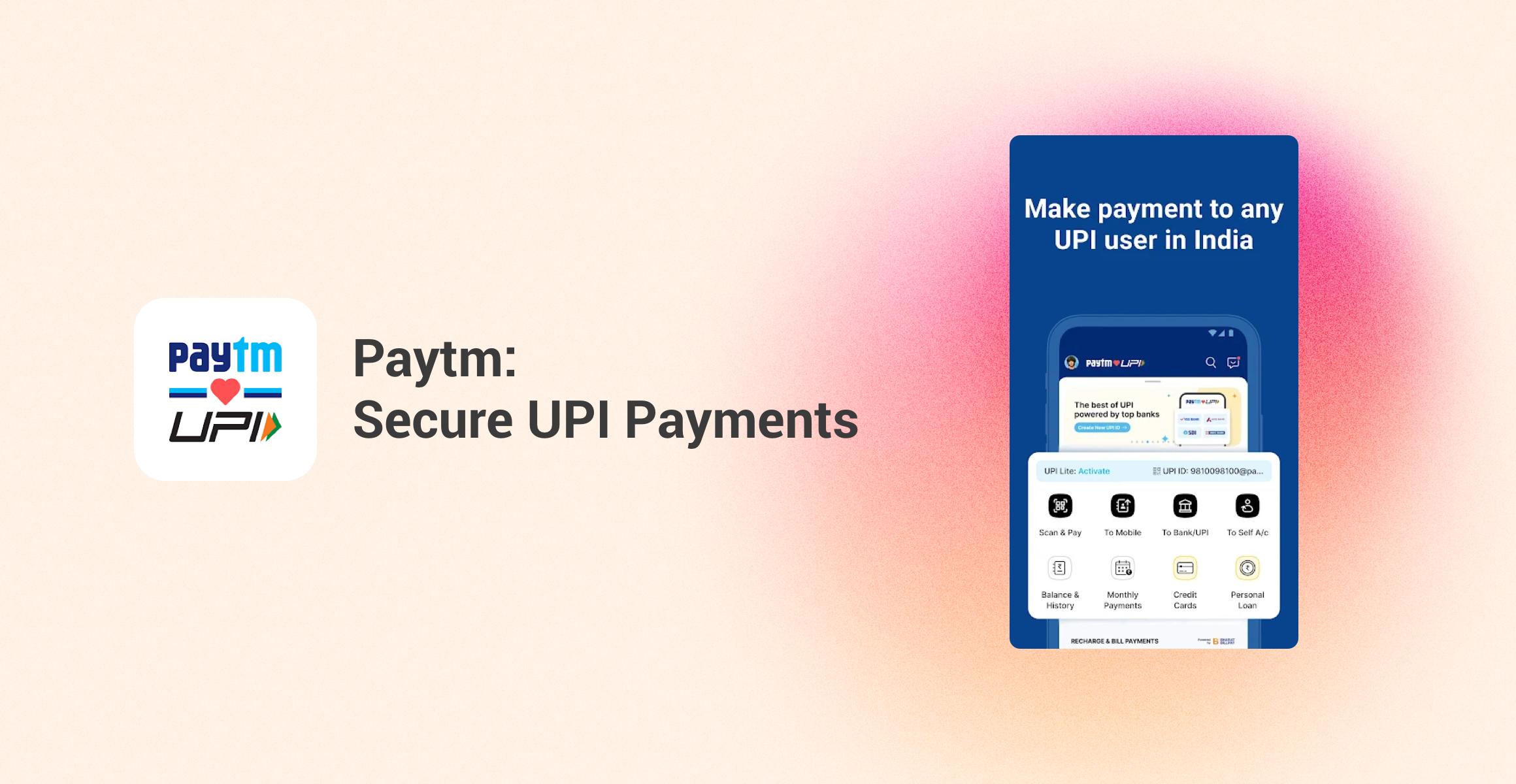

Paytm

Introduction

Paytm is a widely recognized mobile payment and financial services app predominantly used in India, though it has gained popularity in other regions too. Initially launched as a digital wallet, Paytm has expanded its offerings to include everything from bill payments and shopping to investments and banking services, aiming to be a one-stop financial solutions provider.

User Experience

- Interface Design:Paytm’s interface is vibrant and user-friendly, characterized by a blue and white color scheme that is both inviting and functional. The design is clutter-free, with large icons and clear fonts that enhance readability. Key functions such as money transfers, bill payments, and recharges are prominently displayed on the home screen, making navigation intuitive and straightforward.

- Interactive Design:The app excels in usability, featuring a logical navigation structure that makes it easy to discover and use its many features. Actions such as sending money, recharging a phone, or paying a bill can be completed with just a few taps. The app is responsive and quick, contributing to a smooth user experience even during high-traffic times.

- Customization:Paytm offers extensive personalization options. Users can link multiple bank accounts, customize the home screen with frequently used services, and set up automatic payments for recurring bills. The app also allows users to choose preferred payment methods and adjust notification settings to stay informed about transactions and promotional offers.

- Stability and Performance:Paytm is known for its reliability and performance. It handles large volumes of transactions efficiently without noticeable slowdowns. The app receives regular updates to improve functionality and security, addressing any bugs or glitches promptly. In my experience, Paytm is stable and rarely crashes, providing a dependable platform for handling financial needs.

Features

- Core Functions:At its core, Paytm excels in digital wallet and payment services. Users can add money to their Paytm wallet, send and receive money, and pay for a wide range of services, including utilities, DTH, mobile recharges, and movie tickets. The QR code scanner facilitates easy and quick payments at stores.

- Additional Functions:Beyond the basics, Paytm offers a suite of additional services. These include insurance, gold investments, and banking services through Paytm Payments Bank. The app also supports booking flights, trains, and buses, shopping for a variety of goods, and investing in mutual funds, making it a comprehensive financial ecosystem.

- Innovation:Paytm’s innovative feature is its integration of financial services within one app. The ability to invest in gold, buy insurance, and open a savings account all within the app is a testament to its forward-thinking approach. Additionally, the incorporation of loan services and credit score tracking demonstrates its commitment to providing holistic financial solutions.

Community and Support

- Community Engagement:Paytm has a highly active user community, especially within its primary market in India. Forums, social media, and local meetups facilitate a strong community presence where users share tips, resolve issues, and discuss new features.

- Customer Service:Paytm provides robust customer support through multiple channels, including live chat, email, and an extensive help center. The response time is generally quick, and the support team is knowledgeable and helpful. Regular updates and community feedback integration highlight Paytm’s dedication to improving user experience.

Market Positioning

- Target Audience:Paytm is designed for a broad audience, including urban and rural users, small businesses, and individuals looking for a comprehensive financial tool. Its wide range of services makes it particularly appealing to users who prefer a single app for all their financial transactions.

- Competitors:Competing apps like Google Pay and PhonePe offer similar services in the digital payments space. Google Pay excels in simplicity and integration with other Google services, while PhonePe provides a seamless UPI experience. However, Paytm’s extensive range of additional services such as shopping, investments, and banking gives it an edge over its competitors.

Personal Insights

- Highlights:Paytm’s multi-functional capabilities are its biggest draw. The convenience of handling various financial needs within one app is unparalleled. The investment options and banking services make it a robust choice for users looking for more than just a digital wallet.

- Drawbacks:The large number of features can sometimes make the app feel overwhelming. New users might find it challenging to navigate through the myriad of services offered. Additionally, occasional promotional ads can be intrusive.

| View > |

|---|

Ratings:

- Interface Design: 8/10

- Interactive Design: 8/10

- Customization: 9/10

- Performance: 8/10